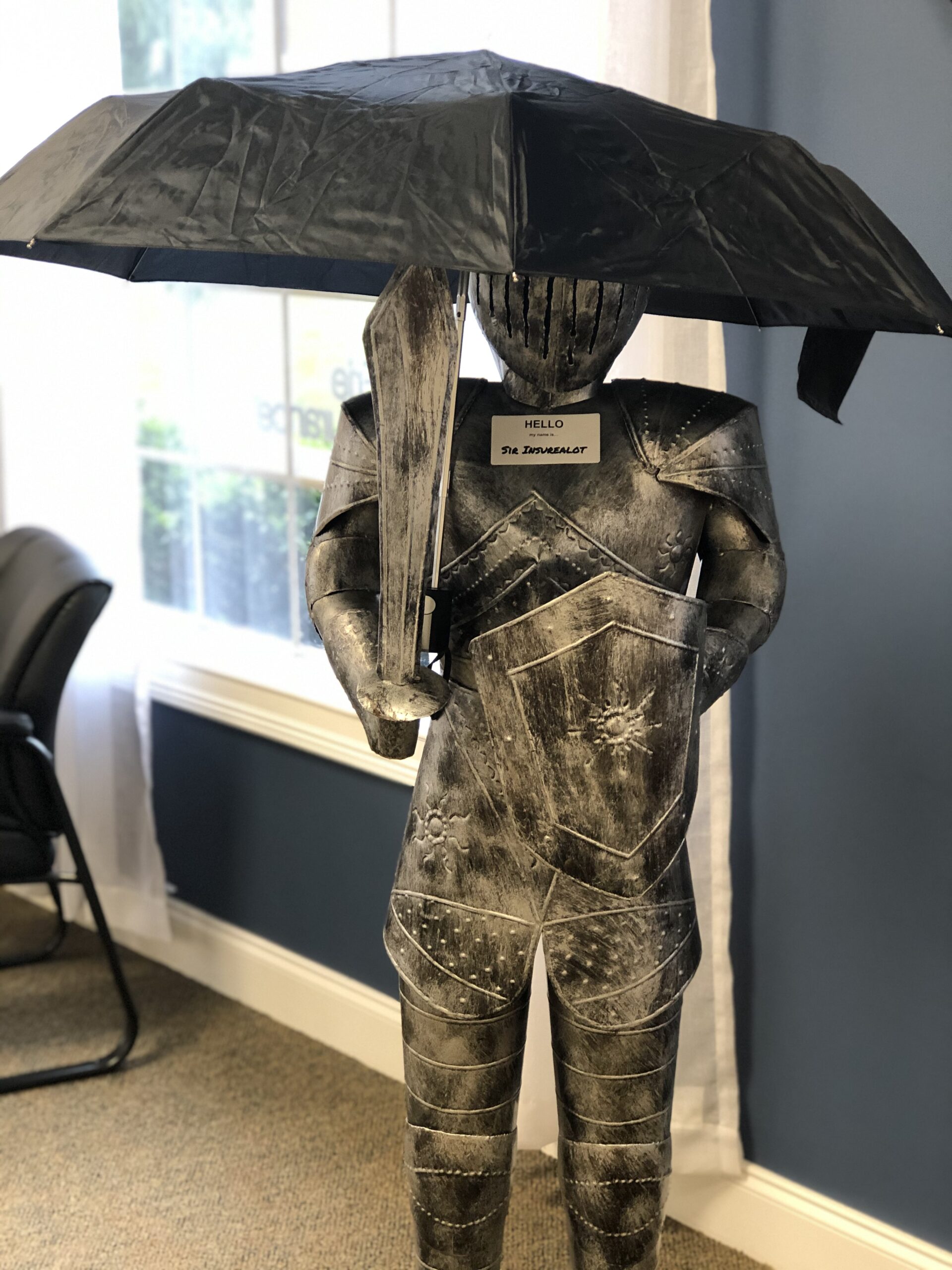

Umbrella Policy?

By Kris Castle

What is an umbrella policy? Do I need one?

Most of us have auto, home, and life insurance, but having protection against a catastrophic liability claim is often overlooked.

Would you have enough coverage if something like this happened to you?

- A jury awarded $900,000 to the estate of a 43 – year – old father that died after an auto accident. The award was based in part on the father’s future earning potential.

- While helping a friend paint his home, a 40 – year – old man fell and broke his heel. Although the homeowner was found only partially responsible, the fall cost him $1.2 million dollars.

An umbrella policy will provide you with an additional $1 million dollars or more of coverage over and above your underlying homeowner or personal auto limits. It can offer you an extra layer of protection against the possibility of a high jury award in a personal liability case.

It is especially important to purchase this type of policy if you have wages that can be garnished or assets that can be seized to pay a judgement.

It’s an inexpensive policy with extensive benefits! Contact your insurance agent or our office for more details.